Daily Diversions in Financial Education: 5 Entertaining Methods for Financial Literacy Instruction

In the world of education, teaching kids about money can often be a challenging task. However, with the right approach, it can be transformed into an enjoyable and engaging experience. Here are some fun and interactive games that do just that.

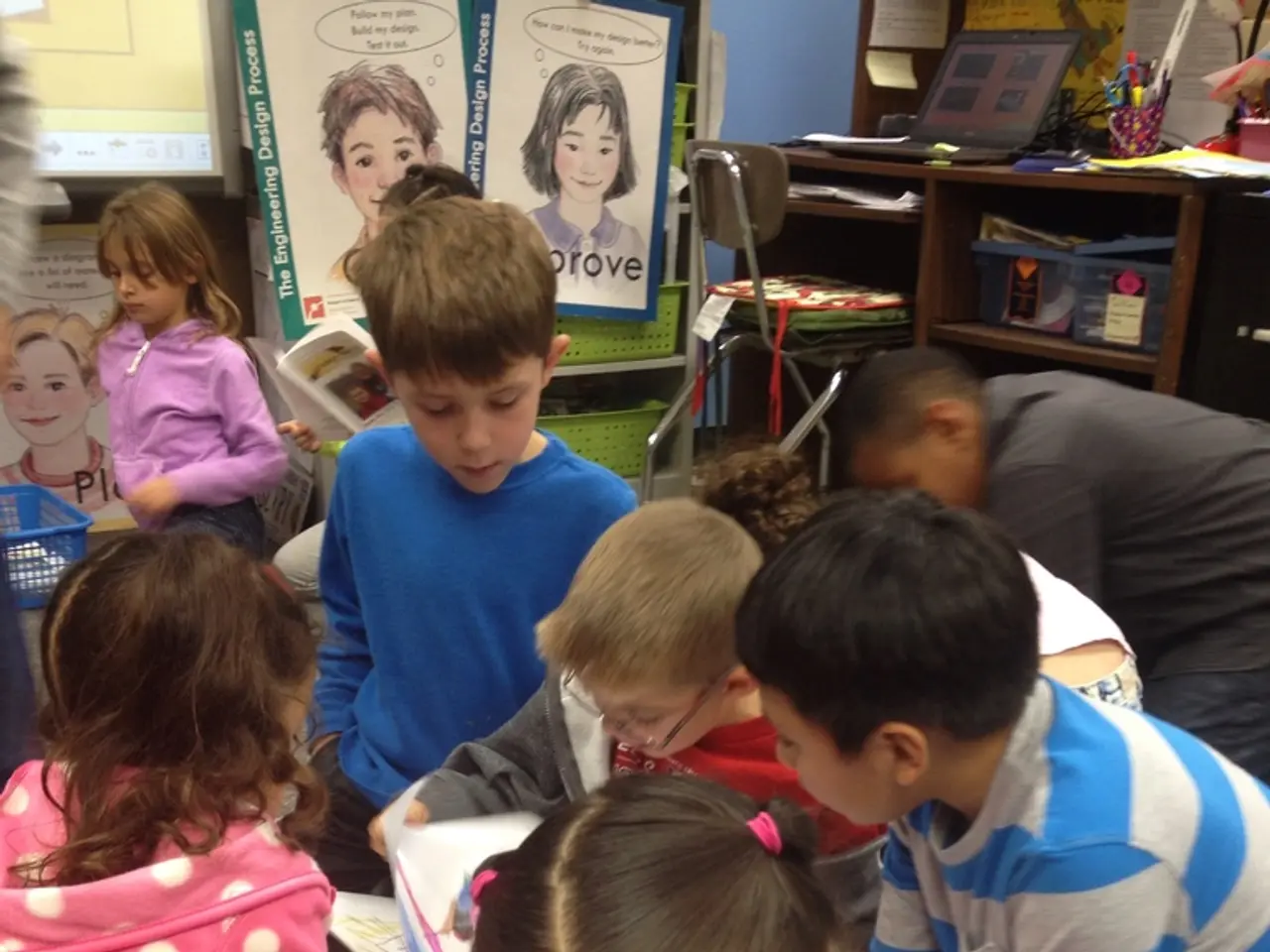

To make learning about money fun and educational, consider using interactive role-playing activities such as "playing shop." In this game, kids act as shopkeepers, buying and selling items, calculating prices, and making change. This not only teaches them about denominations and the value of money but also adds a dose of excitement to the learning process.

Active games that involve physical movement, like "The Money Boat," are another great option. In this game, kids toss coins into a floating container and add their scores, combining math skills with play. The games can be adapted to the child's age and context, making them suitable for kids of all ages.

Classic board games like Monopoly or The Game of Life are also excellent tools for teaching kids about money management, budgeting, and financial decision-making. These games, while fun, naturally teach kids the importance of strategic planning and the consequences of financial decisions.

For older kids, more realistic finance simulations like the game SPENT or The Uber Game can help them understand real-life financial challenges like budgeting with limited funds and making tough money decisions.

Additional ideas for engaging money games include using personalized piggy banks and budgeting challenges to motivate saving and goal-setting. Math card games with money problems can also provide problem-solving practice. To maintain kids’ interest, keep activities short, interactive, and themed with relatable stories.

The main goal of these games is to balance fun with practical financial skills like counting money, adding prices, giving change, budgeting, and understanding saving. By making learning about money enjoyable, kids can develop a positive attitude towards financial management from a young age.

These games are designed to teach preschoolers essential monetary facts in a fun and engaging way. They are suitable for teaching kids about the value of money and its role in everyday transactions. Some popular games include sorting and saving, where preschoolers sort coins into cups labeled with the values 1, 5, and 10. Another game, "Money to jump," involves stashing money in an opaque sack, and the child pulling out notes one at a time to determine the number of times they need to jump, based on the denomination.

The "Puzzle out money" game challenges kids to solve money-related puzzles or problems. For a more creative twist, encourage children to design and draw their own counterfeit money, which can be used to trade for various goods.

With these games, children learn to handle money matters with flair and enthusiasm. They not only make learning about money enjoyable but also help children develop smart money management skills.

- In the realm of parenting and personal growth, incorporating interactive games for teaching kids about money can foster a positive attitude towards financial management.

- Fashion-and-beauty, food-and-drink, home-and-garden, and travel experiences can be utilized as financial decision-making scenarios for older kids in realistic finance simulations like SPENT or The Uber Game.

- In education-and-self-development, using games like "playing shop" and "The Money Boat" enhances children's understanding of money, denominations, and basic math skills while adding excitement to the learning process.

- Relationships between parents and children can be strengthened through fun, interactive, and short activities focused on budgeting, giving change, and counting money.

- In a lifestyle context, personalized piggy banks and budgeting challenges motivate saving and goal-setting in children.

- Caring for pets, like dogs or cats, can also teach kids valuable financial skills, such as managing small budgets, balancing funds for pet food, and the importance of saving for unexpected medical expenses.